Open Enrollment is now closed

Contact the HR team with any questions

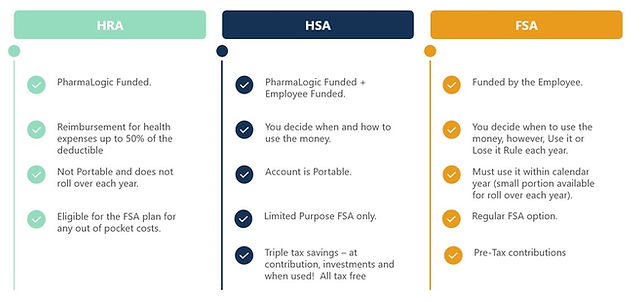

Tax Savings Plans

PharmaLogic provides you several opportunities to save on your taxes and pay out of pocket expenses tax free.

Learn more about our Health Reimbursement Arrangement, Health Savings Account or Flexible Spending Accounts.

You can join the FSA if you choose the HRA or PPO Plan.

You can contribute to the HSA plan and contribute your own money.

Additionally, you can elect a Limited Purpose FSA if you elect the HSA for your dental and vision out of pocket costs.

All employees can choose the Dependent Care FSA if you have childcare expenses to care for your child (up to age 13).

PharmaLogic Helps You Start Your Fund

In 2026, PharmaLogic is contributing towards your healthcare costs in more ways than one.

If you choose the Employer Funded HRA plan, we will provide up to $3,500 for an individual plan and $7,000 for a family plan toward your healthcare costs. PharmaLogic pays first, you pay after the HRA fund has been exhausted.

Or choose the HSA Plan, where PharmaLogic will deposit either $1,500 for an individual plan or $3,000 for a family plan into your account. You must open your account first. You decide when and where to use this money.

Learn more about the different accounts.

Health Reimbursement Arrangement - HRA

The Health Reimbursement Account (HRA) is an employer-funded benefit provided by PharmaLogic that works alongside the HRA Medical Plan. PharmaLogic contributes money to your HRA to help cover eligible medical expenses. The account is administered by Cigna, and when you receive covered care, eligible expenses are automatically applied from your HRA—so there’s nothing you need to submit or manage. Your full employer contribution is available to you from day one, helping reduce your out-of-pocket medical costs.

HRA Employer Contribution

PharmaLogic will contribute the following amount to your HRA. You will have access to the full contributions beginning March 1.

This is the 1st dollar coverage; Cigna will automatically process eligible expenses against the employer contribution.

In addition to the HRA, you may enroll in an FSA and make tax-free contributions to pay for eligible expenses that are NOT covered by your employer sponsored HRA.

The HRA is not portable. If you leave PharmaLogic, you are not able to take your HRA with you. It is a use it or lose it account.

Health Savings Account - HSA

An HSA is a personal healthcare bank account you can use to pay out-of-pocket medical expenses with pretax dollars. If you enroll in the HSA Plan, you can open an HSA. You own your HSA. You determine how much you contribute to your account, up to the annual maximum limits when to use your money to pay for qualified medical expenses, and when to reimburse yourself. Remember, this is a bank account; you must have money in the account before you can spend it. In addition, PharmaLogic will be contributing funds to eligible employees’ HSAs, and that employer contribution counts toward the annual IRS HSA limit. The 2026 calendar year maximum includes any HSA contributions made in January and February, which will count toward your 2026 total annual limit.

Tax savings:

• Contributions are tax-free

• Investments grow tax-free

• Qualified withdrawals are tax-free

Reduced out-of-pocket costs:

You can use the money in your HSA to pay for eligible medical, dental and vision expenses and prescriptions. The HSA funds you use can help you meet your plan’s annual deductible by applying funds towards eligible expenses.

Beyond PharmaLogic:

Your HSA funds are always yours and money rolls over each year. You can invest your HSA to grow even more You must have $2,000 minimum in your account before you can begin to invest your funds. Funds are available for future healthcare costs, even in retirement

Use HSA funds on:

You, your spouse, and dependent children. Even if they’re not covered by your health plan

Once you are enrolled in Medicare, even Part A, you are no longer eligible to contribute to the HSA but can continue using existing funds. Please contact HR for additional information.

Children must be claimed as a dependent on your tax forms to utilize the HSA funds (in other words, if your 24 child is on your medical plan, if they are not claimed on your tax return, they can't utilize your HSA account - but could establish their own.

Flexible Spending Account - FSA

PharmaLogic offers three flexible spending account (FSA) options—the healthcare, limited-purpose, and dependent care FSAs —which allow you to pay for eligible expenses with pre-tax dollars. The FSAs are administered by WEX. Log into your account at wexinc.com to view your account balance(s), calculate tax savings, view eligible expenses, download forms, view transaction history, and more.

Healthcare FSA

The healthcare FSA allows you to pay for eligible out of-pocket expenses, such as deductibles, copays, and other health-related expenses, that are not paid by the medical, dental, or vision plans. Any unused funds exceeding the carryover amount at the end of the year will be forfeited.

Limited-Purpose FSA (LPFSA)

If you are enrolled in the HSA medical plan you are eligible to enroll in the LPFSA. IRS rules state that you cannot have both an HSA and healthcare FSA since both apply funds toward your medical expenses. A LPFSA is much like a healthcare FSA but the LPFSA is set up to reimburse only eligible dental and vision expenses. Any unused funds exceeding the carryover amount at the end of the year will be forfeited.

Dependent Care FSA (DCFSA)

DCFSAs allow you to set aside money pre-tax to pay eligible out-of-pocket day care expenses so that you or your spouse can work or attend school full-time. You must contribute money through payroll deduction to your DCFSA before you can spend it. During open enrollment, you must decide how much to set aside for this account in 2026.

Carryover Benefit

The maximum contribution in 2026 for the healthcare and limited-purpose flexible spending accounts is $2,800 per household. Our plan has a carryover feature that allows up to $680 of your unused funds to be carried forward to the following plan year. These carryover dollars can be used for expenses incurred at any point within the new plan year. Any unused amount over $680 will be lost.

For a list of IRS allowable expenses, visit irs.gov

© 2026 Benefits from PharmaLogic. Powered and secured by Wix

This site provides highlights of the current policies and benefits at PharmaLogic as they apply to eligible employees. Complete details of the plan can be found in the legal documents. If there is any difference in the information on this website and the legal plan documents, the legal plan documents govern. PharmaLogic reserves the right to terminate, suspend, withdraw, amend or modify any of the plans or policies at any time for any reason.